Amazon's Financial Surge in 2024: What It Means for Brands

After a robust return to form in 2023, Amazon has reported better-than-expected results for the first quarter of 2024 and the past twelve months. Here's a look at the key statistics from Amazon's latest financial release:

Revenue:

For the quarter ending March 31, 2024: $143.313 billion, a 12.53% increase year-over-year.

For the twelve months ending March 31, 2024: $590.740 billion, a 12.54% increase year-over-year.

Net Income:

For the quarter ending March 31, 2024: $10.431 billion, a 228.85% increase year-over-year.

For the twelve months ending March 31, 2024: $37.684 billion, a 777.6% increase year-over-year.

Gross Profit:

For the quarter ending March 31, 2024: $70.680 billion, an 18.66% increase year-over-year.

For the twelve months ending March 31, 2024: $281.159 billion, a 19.76% increase year-over-year.

What Does This Mean for Brands?

Amazon's strong financial performance underscores its continued appeal as a platform for brands. However, the emphasis on profitability presents new challenges and opportunities for those looking to thrive on Amazon.

The Good News: Amazon's growth trajectory confirms its potential as a lucrative marketplace for brands. The company's unwavering commitment to a customer-first philosophy continues to drive its success, making it an attractive space for brands aiming to expand their reach and impact.

The Not-So-Good News: The drive for higher profitability means Amazon exerts more pressure on brands to accept tougher terms during AVNs. Brands might face demands to sacrifice margins, making it crucial to adapt and strategise accordingly. In this environment, understanding and managing profitability becomes essential.

What Can Brands Do?

Customised Approaches: Every brand's situation is unique, and there is no one-size-fits-all solution for navigating AVNs. Successful strategies should be tailored to individual circumstances and objectives. However, a common thread for all brands is the need for a deep understanding of product and account-level profitability.

Answer the basic questions: Brands should focus on answering some elementar questions about their products such as:

Which products should we prioritise?

Which products should we deprioritise?

Which products drive growth?

Which products drive profitability?

What are the controllable versus less controllable costs?

This analysis will enable brands to make informed decisions regarding product focus, advertising spend, Amazon terms, operations, and more.

Utilizing Profitability Insights: Recognising the confusion many brands faced last year regarding their true profitability, tools and dashboards that provide clear profitability insights can be invaluable.

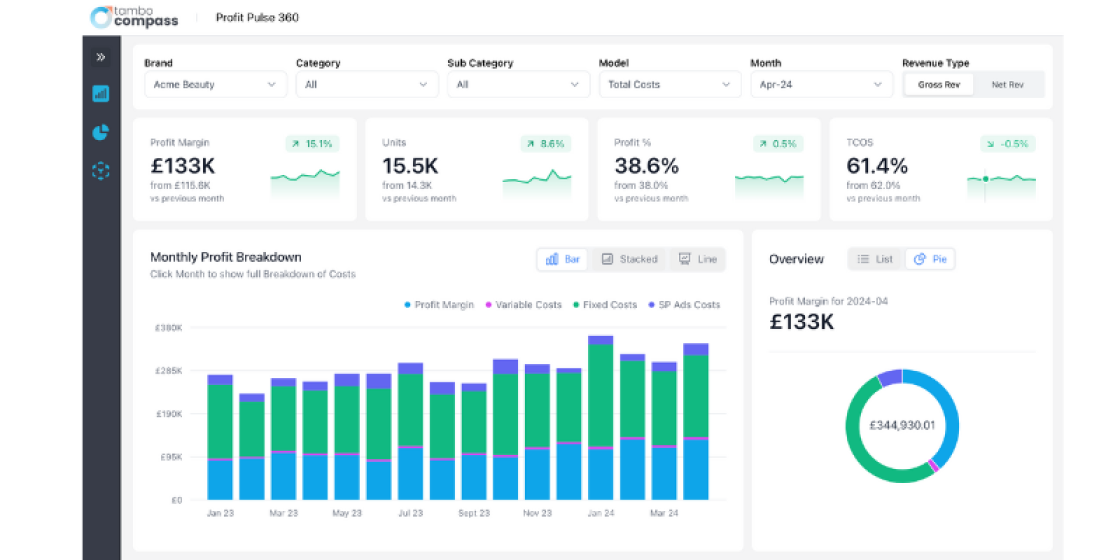

To address this, we developed Profit Pulse 360. This suite of dashboards helps brands fully understand all aspects of their profitability, from Net PPM to brand net profit, preparing them for AVNs. It includes insight-to-action dashboards that segment products based on profitability, enabling brands to take a strategic approach to optimise margins.

We feel responsible for providing brands with the tools and technologies they need to make informed decisions, and we will continue to develop Tambo Compass, our Amazon and AMC analytics suite, to empower brands to make better decisions and achieve healthier returns.

Wrapping Up

Amazon's latest financial results highlight its continued dominance and potential as a marketplace. Brands that adapt to the evolving landscape by leveraging detailed profitability insights and tailoring their strategies accordingly will be better positioned to succeed. By focusing on both growth and profitability, brands can navigate the challenges of AVNs and achieve healthier returns on Amazon.