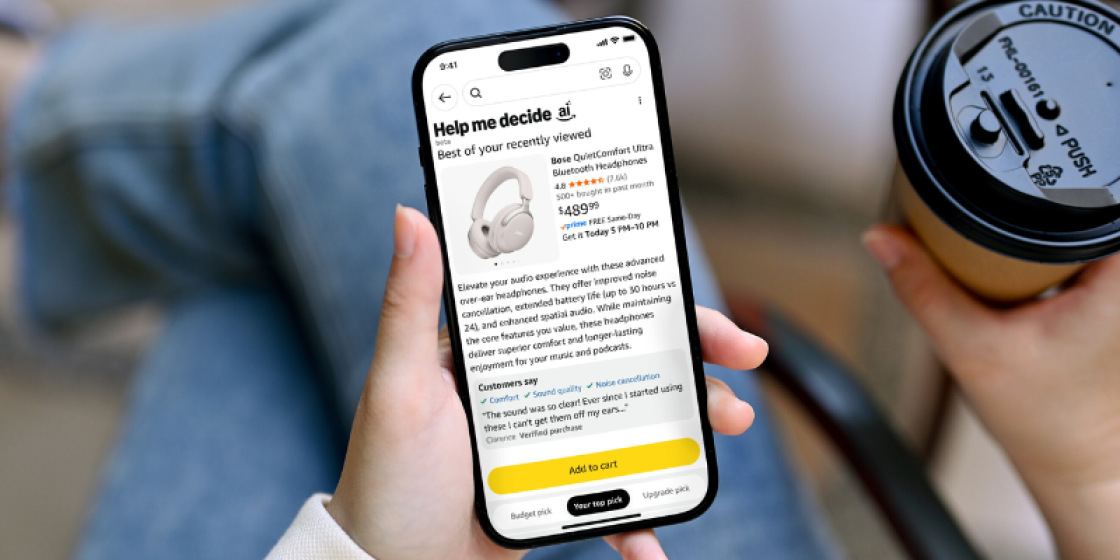

Amazon Launches "Help Me Decide" Feature

Amazon US has launched a new AI-powered Help Me Decide button on mobile, designed to simplify the shopping experience. Once a shopper has looked at multiple similar items within a category, the button appears on the product detail page (and also via a ‘Keep shopping for’ link). Help Me Decide sifts through the shopper’s browsing history, previous purchases, preferences, and relevant product information (specs, reviews, etc.), then gives a single best recommendation based on a best match. It also offers a justification for the pick, and often even surfaces an upgrade and budget option.

Under the hood, it’s built on large language models and Amazon’s internal stack, to contextualize user intent and map it against product attributes.

Key benefits

- Reduced friction in decision-making. For many browsers stuck between two or three choices, Help Me Decide can push them over the line – removing choice paralysis which can sometimes come with the breadth of choice on Amazon.

2. Personalization at scale. Because it combines behavioural signals (browsing, purchases) with product data, it aims to make relevant, credible suggestions tailored to you.

3. Educational + transparent. The feature doesn’t just say “this is your best pick”, it explains why, which can build trust.

4. Flexible alternatives. By also showing upgrade or budget variants, it doesn’t lock users into one narrow choice.Whilst this all sounds great as a shopper, it does bring potential risk for brands. The algorithm leans heavily on past behaviour, so new or divergent products may struggle to surface.

However, this is a smart move by Amazon, and one to watch closely. It essentially introduces another decision touchpoint between viewing and buying, shifting more leverage to Amazon’s algorithm.

For me, a few implications:

- Product content and signal quality become ever more critical. If a product’s specs, images, reviews, and metadata don’t align well with what the AI expects, it might always lose out in that single recommendation. Brands need to ensure their listings speak clearly and richly.

- Differentiation via edge cases can help. If most products in a niche are quite similar, they become ‘competing neighbours’ in the AI’s ranking. Brands that can introduce standout features, or position themselves to match particular user signals, may escape the also-ran zone.

- Testing and feedback will matter. When/if the tool rolls out more broadly (other geographies, desktop, app), we’ll need to track how many conversions come via the Help Me Decide path vs classic browsing routes. That insight will guide how clients allocate their optimization budgets (e.g. content, reviews, ads). However, it remains to be seen if Amazon will share this data – we’re yet to be able to access this insight for Rufus.

- Ad strategy adjustment. It’s possible sponsored placements or bids might be more or less effective if Help Me Decide interrupts typical browsing-to-search flow. Clients may need new bidding and targeting logic for users likely to trigger this tool.

Overall, Help Me Decide is a subtle but potentially powerful nudge in Amazon’s favour, one more way to streamline choices while steering customers closer to what Amazon believes is the “right” product. As with any algorithmic lever, success for sellers will come from anticipating how it thinks, then ensuring your products are built, presented, and positioned to align.