Amazon vs China: UK E-commerce Showdown

In 2023 Amazon struggled to drive customer growth in the UK. Traffic to their web and mobile app was marginally down on 2022 with visitors averaging approx 330m/month*

We think Amazon will face even more competition in 2024 with most of it coming from China.

The rise of the deep discounters, Temu and Shein have dramatically increased their share of the discount space in the US from 2% to 17% in 12 months and we think these mobile marketplace giants will come over to the UK in 2024.

TikTok’s Shop will continue to steal share from Amazon. Firstly, because they have become the place to discover and buy trending products, and secondly because the sales margins are significantly better than Amazon (even with the latest announcement), therefore more attractive to sellers.

And finally, new category marketplaces will emerge in more specialist areas such as beauty, home & personal care, DIY and sport. Big retailers like Tesco and Boots will finally open their marketplaces as they look to copy Walmart's omnichannel model. There will be new hyper-local marketplaces connecting buyers to local sellers particularly appealing to fresh produce or artisan goods.

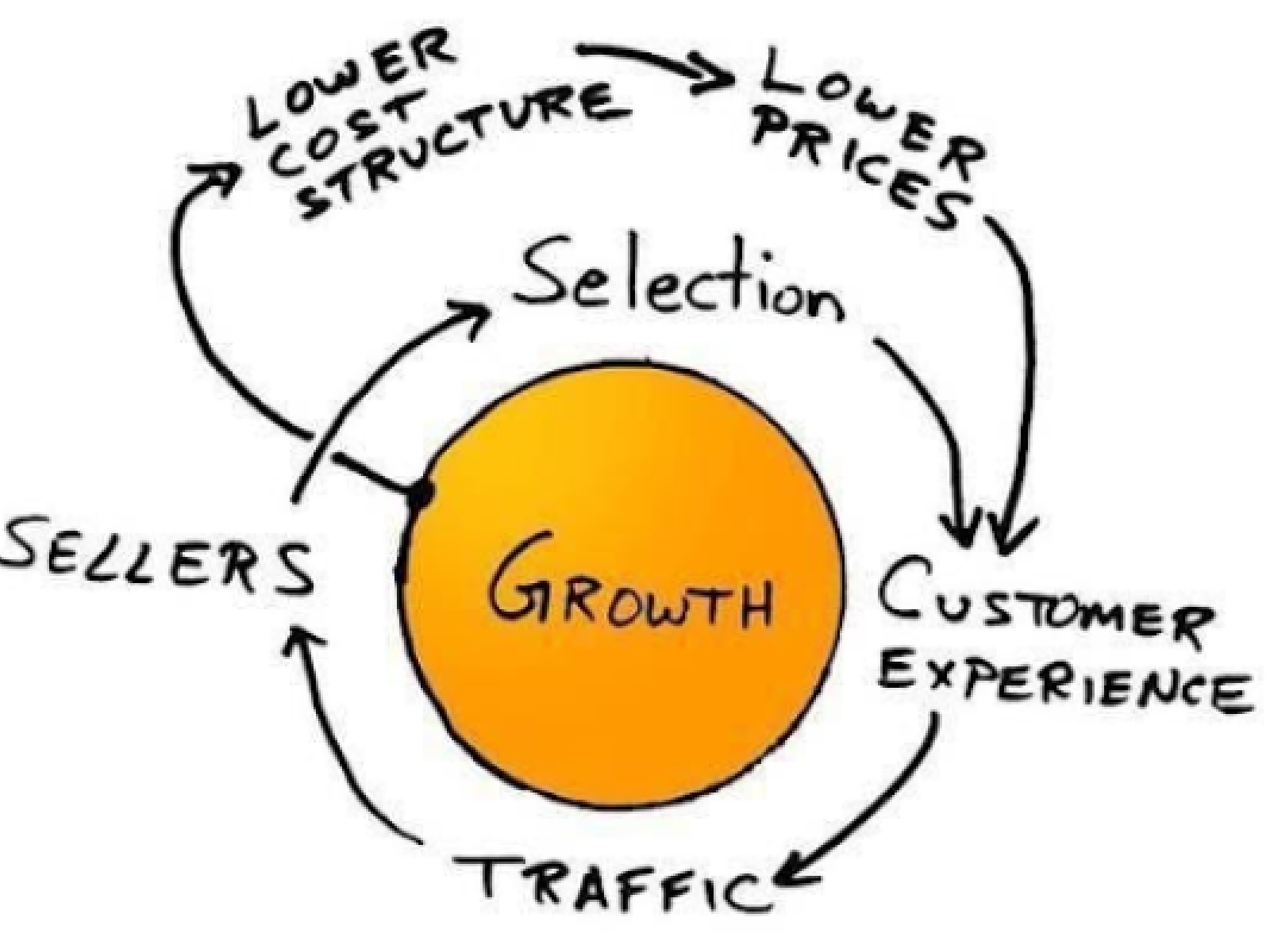

Despite these strong headwinds, Amazon’s focus in Europe will remain on profitability whilst maintaining moderate growth.

Ruthless efficiency

Amazon will find new ways to save money. They will continue to push vendors to an EU relationship model to save money and expect them to decrease margins. They will further penalise sellers that don’t meet their operational requirements and increase the cost to serve in some categories. They will reduce access to humans by enhancing the seller platform using AI to automate more processes. Sellers with products that are poorly packaged or don’t meet sustainability standards will get increased fines. The emphasis will be on persuading the seller to conform to operational standards which improves their efficiency.

Advertising - the Golden child

Amazon’s advertising business will keep expanding, as they open up their video streaming services to advertising, create new TV data partnerships (e.g. NBC), add more precision targeting capabilities, extend into social media platforms, automate advertising optimisation and provide access for sellers to run brand campaigns across the Amazon ecosystem.

This is opening up Amazon to non-endemic advertisers hungry to use Amazon data for targeting customers in the awareness and consideration stage.

Given Amazon’s move towards upper funnel marketing, video is becoming essential as a creative format to capitalise on Amazon’s brand building opportunity on and off platform.

AI everywhere

AI will be further embedded into Amazon’s software platform, improving customer experience across retail, devices and entertainment. With this in mind, we expect Amazon search to become AI driven, changing the way that product pages will need to be prepared to be visible in search results.

Enhanced personalisation

An AI powered search bar will be launched that will provide customers with personalised suggestions, making it easier for them to find relevant products and ads. There will be more dynamic ad targeting, tailored to user profiles, browsing history, purchase behaviour and even offline data. Brands will be able to serve different creative to different audience segments.

Drone delivery will go live in the UK across limited postcodes signalling amazon’s capability to deliver products to your home or wherever you happen to be right now. This will enable customers to make more impulse buys onsmaller basket items. We can’t wait to try it out!

Better analytics

AMC will expand to include seller data making the data warehouse a more powerful source of insight. An ecosystem of apps and integrators will start up designed by Amazon and third parties that will make it easier to analyse and use the data. AMC will move into an AWS environment making it safer, more secure, faster and more useful. Brands will be more open to using AMC as the data will be separated from the prying eyes of Amazon.

We are confident that anyone using our Tambo compass AMC solutions will have a significant advantage in the marketplace.

Sustainable or not

Amazon will give more presence to sustainable brands in search, clearly labelling those businesses that make more effort to produce carbon neutral, ethically sourced and eco-friendly products and packaging. They will introduce new initiatives to drive up sustainable standards and penalise businesses that fail to meet them. There will be a clear divide between those that are in or out.

Product Discovery features

Amazon’s major weakness is their product discovery experience. The platform lacks inspiration and interactivity. In 2023 they started to address this. They kickstarted their influencer programme and integrated Amazon into Meta and other social platforms. In 2024 we expect to see more video, more interactivity on product pages, more emphasis in search results of influencer curated ranges, more tools to enhance product experience and new live streams in category storefronts. And outside of Amazon, brands will be able to reach customers on social platforms using Amazon data to improve targeting and connect product discovery directly to sales

Final thoughts

We are sure that there will be some surprises too, but we are confident these themes will play out in 2024. If you are with Tambo, we will be here again to guide you through the year making sure that your brand is using the very latest Amazon technology and services to drive performance. If not, get on board with us and enjoy the ride!