2023: Resilience in the face of global storms

Happy New Year!

As you start to ease yourself back into work from the Christmas holiday, we thought it would be useful to step away from the current news and reflect on how Amazon performed and what they delivered in 2023.

Next week, we will lay out our predictions for Amazon in 2024.

Enjoy the read!

Resilience in the Face of Adversity

Despite global economic uncertainty, Amazon demonstrated its ability to adapt and grow driven by its diversified business model and strong cloud and advertising business. They prioritised profitability over revenue growth, which slowed slightly over the quarters. Black Friday and Prime Day sales growth was modest (+5.8% and 8% respectively). Amazon continued to make most of its money from AWS and North America retail. The international business is set to make a staggering $6 billion loss. It’s no surprise therefore that annual vendor terms negotiations are getting tougher every year and sellers increasingly face suppressions for unprofitable products.

If you want to get to grips with Amazon Profitability sign up to Tambo Compass Pro, a tool for vendors and seller to dynamically manage profitability at an product level

Healthcare Expansion

Amazon continued to make strategic investments in healthcare with expansion of their Pharmacy division via the purchase of One Medical and extensions to the range of drugs offered by their OTC and Prescription services. Whilst their strategic ambitions in healthcare are clear, their grocery intentions remain muddled. There were plenty of announcements of new stores opening, new partnerships agreed (e.g. Iceland) and enhanced offers (e.g. Free delivery with Prime) but nothing significant. No step change and no initiative that will trouble the Key Market Grocers. Will this ever change?

Tambo has a specialist division - Tambo Health, that is designed for the unique needs of this segment. Specifically, we know how to navigate the legal and compliance requirements to sell on Amazon.Please get in touchto find out more.

Seller Growth Despite Dissatisfaction

Source: Sellerapp 2023

Despite the rising costs of selling on Amazon, sellers are still joining the platform. Amazon finished 2023 with approx 2.5million active sellers, a 25% increase on 2022. Whilst the numbers are rising, churn has increased and sellers have become increasingly dissatisfied with Amazon practices. However, whilst there is no meaningful alternative and the expense of running your own DTC site escalates, we can’t see any change in Amazon’s popularity in the near future.

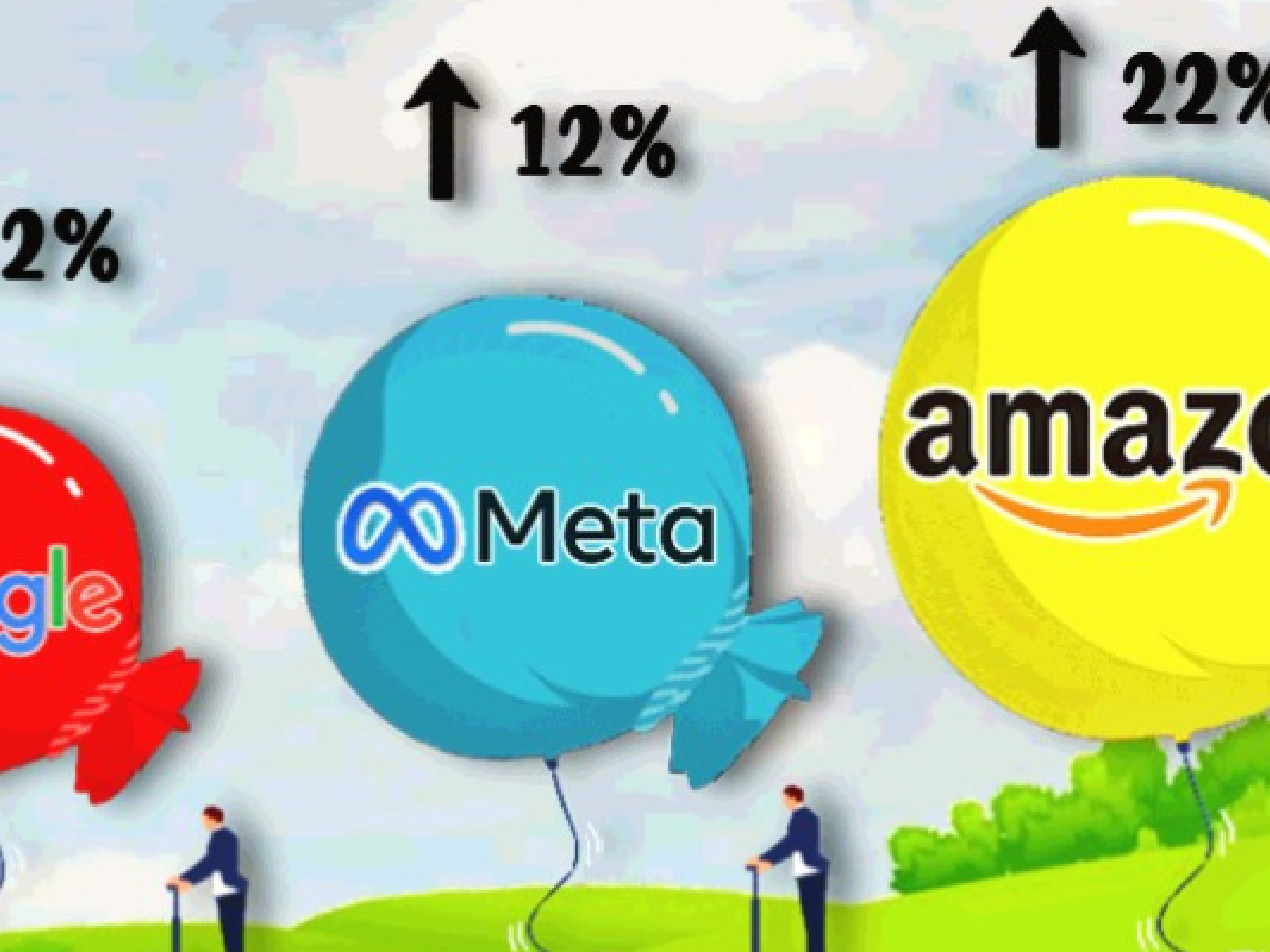

Amazon Advertising is the Rising Star

Amazon’s advertising business has been the rising star in 2023. They now have a 7.3% market share and their growth is outpacing Meta and Google. Amazon’s strength over rivals is their direct connection to e-commerce and precision targeting. Meta and Google are still preferred for brand awareness and reach, but this is changing as Amazon starts to build connections to social media, create global events (e.g. Black Friday NFL game) and expand video streaming via Prime Video and Twitch. Amazon is now the biggest advertising video streaming platform in the world.

Tambo is an Advanced Partner of Amazon Advertising, with skills and experience with global brands using Sponsored Ads and DSP across all formats, including video.

Amazon Marketing Cloud Bursts onto the Scene

Amazon Marketing Cloud (AMC) burst onto the scene in 2023 offering advanced advertising analytics & custom audience creation. Data Management Platforms are commonplace, but this was the first time advertisers had a window into Amazon data and could use it to create highly targeted campaigns.

Tambo is a leading provider of AMC reporting, analytics and tools that helps brands understand the amazon customer and develop precision targeted campaigns.

Amazon Tech: Nothing much new

There were no big announcements in 2023 on the tech front, instead Amazon made enhancements to many existing products, improving their design, connectivity, speed or application. AI started to become integrated into Amazon retail to improve service (e.g. auto generated creative), customer experience (e.g. customer review summaries) and search performance.

Amazon’s most dramatic product announcement was Alexa Smart Glasses through a partnership with Luxottica. Anyone old enough to remember Google Glass won’t be investing in this new technology!

The Rise of Discount Marketplaces

Elsewhere, retailers were more focused on core business so haven’t really troubled Amazon. We saw retail media gather pace with improved media offering and some improvements to platform design. However, Amazon is by far the most dominant player still. Temu and Shein saw a meteoric rise in the US and will be an increasing threat to Amazon in 2024 and beyond. Some retailers opened up new marketplaces (e.g Superdrug) and many more were announced but not delivered yet (e.g. Boots and Tesco).

Tambo can help you get started on any global marketplace or social commerce platform.Please get in touch to discover which marketplaces are best suited for your brand.

*Similarweb Average Jan - Nov 2023 v same period 2022)

If you would like to talk to me about anything in this update please email me directly via paul@tambo.io